I'm getting a lot of emails asking me to recommend an options advisory service. If you currently subscribe to an option trading service, or if you’re considering doing so, here are some tips how to select one. Those tips will help you to avoid some costly mistakes.

Red Flags to Watch

- The service doesn’t have any losing trades

WE RECOMMEND THE VIDEO: Binary Option Trading(92% ROI)

92% in one minute binary option trading.

- The service won’t show you their closed trades. If you aren’t allowed to see all of the previous trade alerts that they’ve created, then what are they hiding? The service should stand behind all of their trades, both the winners and the losers.

- The trades have huge risk. Beware of option trades that sell options naked, which means selling the option by itself which gives the trader huge risk. It may look like easy money, but eventually you’ll get burned very badly doing this.

- The service inflates their ROI numbers. Profits and losses should be calculated against the risk in the trade—not the per share cost of the trade. Using the cost of the trade to figure the return can dramatically inflate the ROI and show returns that wouldn’t pass even the most rudimentary accounting standards.

- Uses language like “bull call spread” or “bull put spread.” That language was created by the option trading seminar industry for the purpose of confusing the students and then selling them into the next $3,000 class to clear up the confusion. If the person running your trade alert service uses this language, then he most likely learned to trade from a seminar company rather than from a professional trading firm.

- In-the-money call spreads. If you’re ever shown a trade that’s buying an in-the-money call spread, then 99% of the time the person showing you that trade doesn’t really understand options. Selling the put spread with the same strikes as the call spread is synthetically the same trade in every respect, but it probably gives you a better entry price.

- Selling credit spreads gives you your money up front. There’s no opening trade that gives you money up front. When you trade a credit spread, you’re actually reducing your option buying power in just the same way that your option buying power is reduced when you trade a debit spread. Again, this is a sign that your trading service doesn’t really understand how options work.

- Worried about assignment. If your service ever mentions that being assigned on a short option prior to expiration is a bad thing, run in the other direction. Assignment doesn’t increase your risk or cause you to lose money (other than a commission), but can actually give you more profit. Why doesn’t your trading service understand this?

- Doesn’t give you a trade plan. Every trade should have a detailed exit plan in place before the trade is entered. That’s just standard operating procedure.

- Only trades a bullish market. The idea that the market goes up over time is false. All companies eventually go out of business, or are bought out. The indexes go up over time because they are manipulated, but individual stocks don’t always go up. Just look at a chart of GM. So if your service can’t trade in sideways or down markets, then they’re really just a one-trick pony that’s going to miss a lot of the opportunity in the market.

Performance

Obviously the first thing most traders are looking at is performance. If you cannot find detailed and clear track record, I would definitely stay away.

But even if you do find a track record, you need to know how to read it. Performance data is useless without also analyzing risk. Risk can be measured by Sharpe Ratio which is (Annualized return - risk free rate / annualized volatility). Higher Sharpe Ratio is better (it means higher return with lower volatility).

Click here to read what is Sharpe Ratio and why you should care about it.

Many services report their performance in a completely wrong and misleading way. Please be careful, especially when you see some fantasy land numbers:

(Hint: this service is calculating performance by adding all trades, which means you would need to allocate 100% to each trade to show similar performance. All it takes is one big loser for your account to become toast).

Here are two examples showing how even the most experienced traders can overlook some important facts when evaluating performance.

Princeton Research Ranking

SteadyOptions had the honor to be ranked second on their list, as "another brilliant service that helps subscribers trade options with high levels of accuracy, without having to know anything more than the basics. It also provides guidelines on risk and financial management, to ensure that the risks you assume don’t destroy your accounts entirely."

First place on their list belongs to service that "claims to have a 77% win rate on 3425 trades over 15 years".

Their track record is indeed impressive:

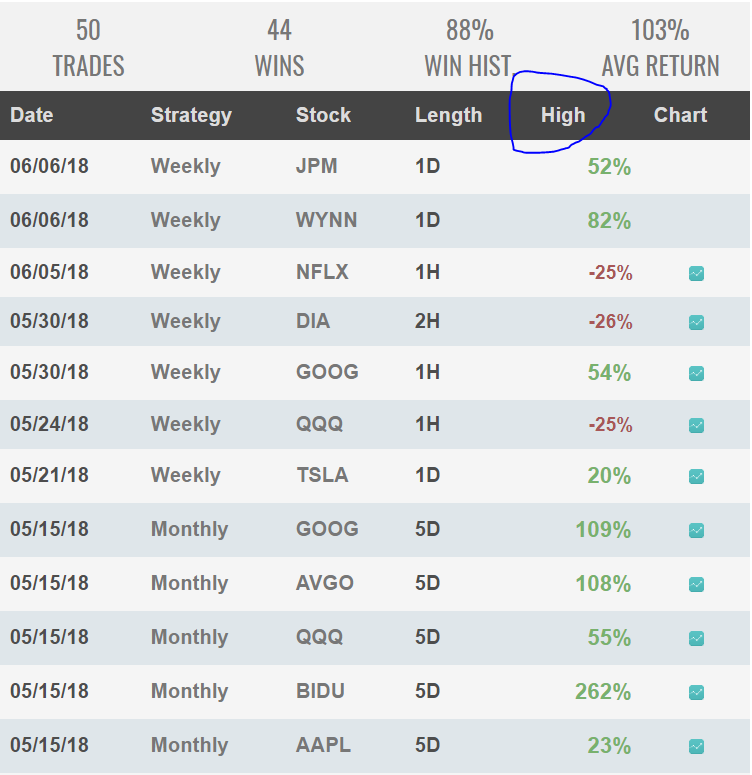

88% winning ratio and 103% average return?? This is beyond impressive.

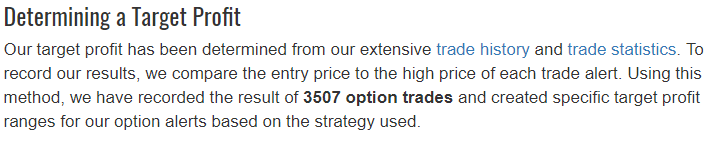

There is only one "small" issue: Those are not real results. You see "High" above the percentage column? The reporting methodology is buried somewhere in the small print:

What it really means is that reported returns are based on the "The highest price the option achieves is recorded as the result since this was historically what the option price reached."

Did you get that? Is anyone really able consistently to sell at the top, or even close?

ToughNickel Rankings

ToughNickel published their research of Best Options Trading Advisory Service.

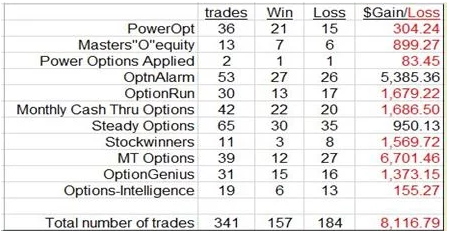

After studying many services they narrowed down the selection to 11 pickers. They then subscribed to the services of these eleven. Shown below are the results of their own trades with these eleven pickers.

"As you can see from the table, except for two pickers, all listed pickers delivered losses. Looking at the numbers, OptionAlarm is the clear winner in the contest with Steady Options coming in second place. Steady Options offers a very conservative and safe trading system but is difficult to follow if you are just following option picks. They require a deep knowledge of the system they use and in most cases leaves it up to the client to decide when and how to enter and exit their selected options."

While we are honored to be among the only two profitable services, there are few things worth mentioning:

First, based on our records, the author of the article was our member for only 3 months. As he mentioned, it takes time to learn our trading system, and members who stick around usually improve their results significantly over time.

Second, it is important to compare apples to apples. The author mentioned that "In order to make the comparisons fair and meaningful I invested the same amount - $1,000 - on each trade." This still doesn't make the comparisons fair. Why? Because the risk is completely different.

Looking at the track record of the first ranker, you can see that around 25% of their trades are 100% losers. In fact, it is not uncommon for them to have five consecutive 100% losers:

Imagine you joined in February 2017 and allocated 10% of your account to each trade. Two months later, your account would lose 50%. While the overall track record is indeed impressive, you just cannot ignore the risk.

Summary

It is important to understand how to evaluate an options advisory service. It is important to understand the strategies they implement and the risks. It is important to understand how they report performance. Some of the questions you should ask:

- Is it based on real trades or hypothetical performance?

- Does it account for position sizing or assumes 100% allocation for each trade?

- Is the P/L calculated based on cash or margin?

What Is SteadyOptions?

Full Trading Plan

Complete Portfolio Approach

Diversified Options Strategies

Exclusive Community Forum

Steady And Consistent Gains

High Quality Education

Risk Management, Portfolio Size

Performance based on real fills

Non-directional Options Strategies

10-15 trade Ideas Per Month

Targets 5-7% Monthly Net Return

Recent Articles

Articles

Pricing Models and Volatility Problems

Most traders are aware of the volatility-related problem with the best-known option pricing model, Black-Scholes. The assumption under this model is that volatility remains constant over the entire remaining life of the option.

By Michael C. Thomsett, August 16

- Added byMichael C. Thomsett

- August 16

Option Arbitrage Risks

Options traders dealing in arbitrage might not appreciate the forms of risk they face. The typical arbitrage position is found in synthetic long or short stock. In these positions, the combined options act exactly like the underlying. This creates the arbitrage.

By Michael C. Thomsett, August 7

- Added byMichael C. Thomsett

- August 7

Why Haven't You Started Investing Yet?

You are probably aware that investment opportunities are great for building wealth. Whether you opt for stocks and shares, precious metals, forex trading, or something else besides, you could afford yourself financial freedom. But if you haven't dipped your toes into the world of investing yet, we have to ask ourselves why.

By Kim, August 7

- Added byKim

- August 7

Historical Drawdowns for Global Equity Portfolios

Globally diversified equity portfolios typically hold thousands of stocks across dozens of countries. This degree of diversification minimizes the risk of a single company, country, or sector. Because of this diversification, investors should be cautious about confusing temporary declines with permanent loss of capital like with single stocks.

By Jesse, August 6

- Added byJesse

- August 6

Types of Volatility

Are most options traders aware of five different types of volatility? Probably not. Most only deal with two types, historical and implied. All five types (historical, implied, future, forecast and seasonal), deserve some explanation and study.

By Michael C. Thomsett, August 1

- Added byMichael C. Thomsett

- August 1

The Performance Gap Between Large Growth and Small Value Stocks

Academic research suggests there are differences in expected returns among stocks over the long-term. Small companies with low fundamental valuations (Small Cap Value) have higher expected returns than big companies with high valuations (Large Cap Growth).

By Jesse, July 21

- Added byJesse

- July 21

How New Traders Can Use Trade Psychology To Succeed

People have been trying to figure out just what makes humans tick for hundreds of years. In some respects, we’ve come a long way, in others, we’ve barely scratched the surface. Like it or not, many industries take advantage of this knowledge to influence our behaviour and buying patterns.

- Added byKim

- July 21

A Reliable Reversal Signal

Options traders struggle constantly with the quest for reliable reversal signals. Finding these lets you time your entry and exit expertly, if you only know how to interpret the signs and pay attention to the trendlines. One such signal is a combination of modified Bollinger Bands and a crossover signal.

By Michael C. Thomsett, July 20

- Added byMichael C. Thomsett

- July 20

Premium at Risk

Should options traders consider “premium at risk” when entering strategies? Most traders focus on calculated maximum profit or loss and breakeven price levels. But inefficiencies in option behavior, especially when close to expiration, make these basic calculations limited in value, and at times misleading.

By Michael C. Thomsett, July 13

- Added byMichael C. Thomsett

- July 13

Diversified Leveraged Anchor Performance

In our continued efforts to improve the Anchor strategy, in April of this year we began tracking a Diversified Leveraged Anchor strategy, under the theory that, over time, a diversified portfolio performs better than an undiversified portfolio in numerous metrics. Not only does overall performance tend to increase, but volatility and drawdowns tend to decrease: