Please note: As required by the European Securities and Markets Authority (ESMA), binary and digital options trading is only available to clients qualified as professional clients.

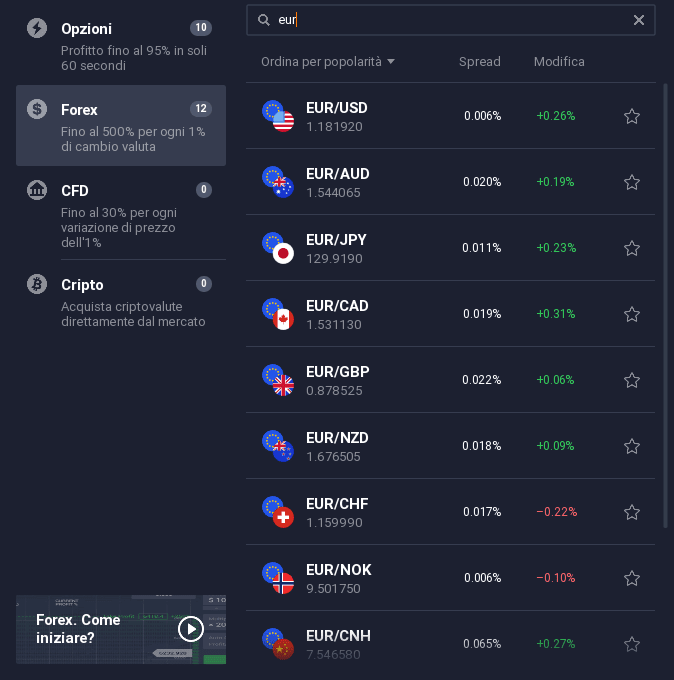

The single currency (EUR) scored two days of good rises against the major world currencies, after the words of Chief Economist of Frankfurt Peter Praet

WE RECOMMEND THE VIDEO: Lightspeed Platform Setup for Trading Options | Tutorial

TexTrading Website - ▻ Join the channel Discord - ▻ Follow me on Twitter - ...

. Specifically, the prominent figure of the European Central Bank has defined as "highly probable" that the end of the Quantitative Easing program will be announced as a result of the forthcoming monetary policy meeting to be held occasionally in "transfer" to Riga, in Latvia

The market reacted by immediately pushing the euro, which against the dollar (USD) re-climbs quota 1.18, a price at which the two major world currencies were not traded since May 22nd. In addition, the market seems to increasingly price the first rate hike by summer 2019. Finally, for the succession to Mario Draghi, Weidmann, the current governor of the Deutsche Bundesbank, seems to increasingly gain consistency.

The latest political developments in Italy, as well as the change of government in Spain, seem to have actually shifted the preferences of Macron's France towards the Berlin candidate. This explosive cocktail of news could only have the effect we witness on the single currency; moreover, as often happens in these situations, the yields of the eurozone government bonds are also rising, with the ten-year Bund more than 0.5%.

The uncertainty about the Italian political situation has led many traders to bet on a more cautious exit from the QE program, which, we recall, has quantitatively surpassed other similar programs put in place by the other central banks of the world.

In the latest ECB report it is highlighted how the total of the purchased bonds, which includes minority also corporate debt of companies based in the monetary jurisdiction of the ECB, has reached 4500 billion euros and has exceeded 40% of the GDP of the annual eurozone.

As for the dollar, it should be stressed that expectations for a further increase in interest rates on Wednesday, a day of monetary meeting also for the FOMC, fell slightly, also due to the reduction in the price of oil collapsed to $ 65 that could help curb the rise in inflation expectations.

GAvviso General Risk

The financial services provided by this website carry a high level of risk and can lead to the loss of all your funds. You should never invest money that you can not afford to lose

Source: IQOption blog 2018-06-07 21:25:43

* This is redirection to the official website where you can sign up to IQ Option broker

Wednesday, 14 August 2019